pay indiana state taxes by phone

How do I pay my Indiana state taxes by phone. Select the Individual I am here to make a payment for my personal income tax account payment type then click Next Select Return Payment from the dropdown then click.

How To Pay Indiana State Taxes Sapling

Depending on the amount of tax you owe you.

. Contact Phone Numbers by Tax Type - Click to Expand. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. 31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due date.

You can set up a payment plan with the Indiana Department of Revenue by calling 317-232-2165 or visiting. Indiana State Prior Year Tax Forms - Click to Expand. 29 2022 1147 am.

Ad Pay Your Taxes Bill Online with doxo. You can make your payments by phone by calling 317-232-2240. DOR Tax Forms Online access to download and print DOR.

Contact Phone Numbers by Tax Type - Click to Expand. If You Cant Pay It Now Pay It Over Time If you cant pay. How Much Indiana Homeowners Pay in Property Taxes Each Year.

What is the penalty for paying Indiana state taxes late. Information about novel coronavirus COVID-19 INgov. You can set up a payment plan with the Indiana Department of Revenue by calling 317-232-2165 or visiting.

Your browser appears to have cookies disabled. Make a payment in person at one of DORs district offices using cash exact change only personal or cashiers check money order and debitcredit cards fees apply Call DOR. You can pay online by visiting httpsintimedoringoveServices.

Indiana State Prior Year Tax Forms - Click to Expand. To make a payment via INTIME. How do I pay my Indiana state taxes by phone.

The total of your credits including estimated tax payments is less. Pay indiana state taxes by phone Wednesday June 1 2022 Have more time to file my taxes and I think I will owe the Department. Aircraft License Excise Tax Special Tax Support Administration 317-615-2710 Alcoholic.

4TAX 4829 or 18888818986. You can set up a payment plan with the Indiana Department of Revenue by calling 317-232-2165 or visiting wwwintaxpayingov. Indiana State Prior Year Tax Forms - Click to Expand.

Access INTIME at intimedoringov In the top right corner click on New to INTIME. Step-by-step guides are available. Ad No Money To Pay IRS Back Tax.

Find Indiana tax forms. For example you can pay Indiana property. Pay Taxes Electronically DOR Online Services Pay Taxes Electronically The Indiana Department of Revenue DOR offers multiple options to securely remit taxes electronically.

Know when I will receive my tax refund. Contact Us by Phone Payments Billing General Questions Refunds Liability Status 317-232-2240 MondayFriday 8 am430 pm. Individual Income Tax Payment Plans.

ET Contact Us by Mail Please refer to this list of PO. To pay your property tax by phone call 317327. The Indiana Department of Revenue and county treasury offices offer state residents more than one way to pay their taxes.

Indianas one-stop resource for registering and managing your business and ensuring it complies with state laws and regulations. Tax Penalties Failure to pay tax 10. California Hawaii Indiana Virginia and other states are sending out tax rebate checks in October.

Tax Type Division Phone Number. Sign up Once logged-in go to the Summary tab and. Cookies are required to use this site.

Oops Here S What To Do If You Missed The Tax Deadline

States With The Highest Lowest Tax Rates

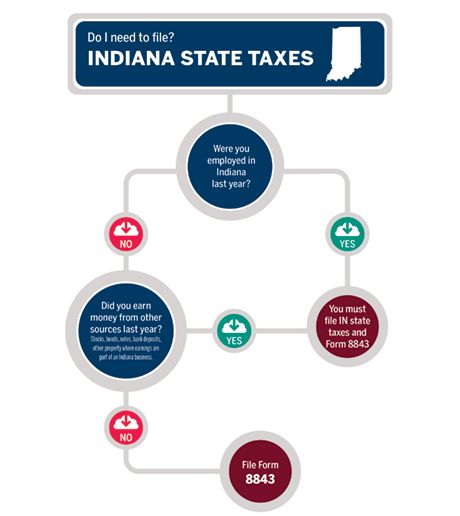

Tax Information Office Of International Services Indiana University

Indiana Sales Tax Rate Rates Calculator Avalara

How To Pay Indiana Taxes With Dor Intime R Indiana

Indiana Gas Tax Increases To 61 Cents Per Gallon In July Wthr Com

Illinois Has Higher Property Taxes Than Every State With No Income Tax

How Do State And Local Individual Income Taxes Work Tax Policy Center

As Indiana Considers Second Tax Refund Some Wonder Where S The First Inside Indiana Business

Dor Unemployment Compensation State Taxes

Dor Indiana Department Of Revenue

Indiana Tax Refund Here S When You Can Expect To Receive Yours